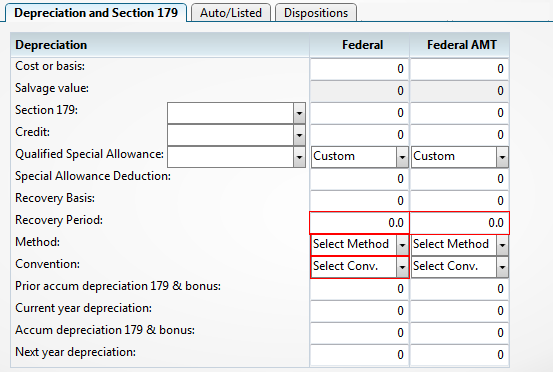

Depreciation and Section 179 Tab

This tab allows for the entry of the assets value in order to calculate the depreciation of the asset.

Click the  button on the Asset Entry toolbar if you've entered or rolled over a Schedule E asset (for example R-4) and you notice that the Recovery Period , Method and/or Convention, and Current Depreciation are not calculating correctly. This will refresh the asset and calculations based on the R-4 type.

button on the Asset Entry toolbar if you've entered or rolled over a Schedule E asset (for example R-4) and you notice that the Recovery Period , Method and/or Convention, and Current Depreciation are not calculating correctly. This will refresh the asset and calculations based on the R-4 type.

To enter depreciation:

- Enter the cost or basis of the asset in the Federal Cost or Basis box.

- The Fixed Assets form will calculate the following based on this entry:

- Federal AMT

- Recovery Period, Method and Convention based on the asset category entered in the Asset Information

- Enter any other applicable information in the space provided.

Depreciation and Section 179 tab on the Fixed Assets form

The calculated entries can be changed if necessary, by selecting the field and entering the changes. The text of the overridden fields will be red. To restore the calculated field, right-click in the field and select Restore.

See Also: